The Reserve Bank of India has given license to a new model of banks, called payment banks. The idea is to take banking to the next level and create bank accounts for many first-time account holders. These banks are restricted to a max balance of INR 1 Lakh and can’t issue loans/credit cards etc. While the payment banks offer enhanced services than a wallet, it is important to understand that they offer limited services as compared to traditional banks.

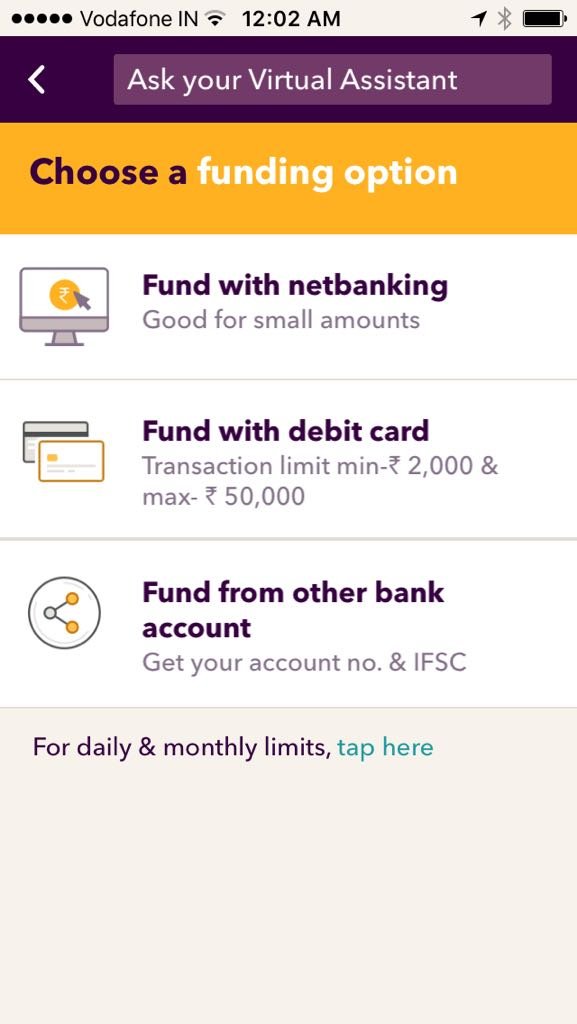

The process of setting up a payment bank account is relatively simple. But the advantage here is that you get benefits like ATM withdrawals, debit cards and most importantly, interest on your amount. Once you’ve installed the app, answer basic details like name, mobile number, and email. Also, you’ll get an OTP to verify these details. Just enter the correct OTP and you’re ready to start using the app. You can add funds to your account using Net banking, pay utility bills, mobile phone recharge, online shopping, and more.

digibank by DBS offers much more than what you get in a payment bank. With digibank you can convert your wallet into a fully functional savings account. You’ll need to visit your nearest Cafe Coffee Day outlet and or have an agent visit your address to complete your biometric verification through fingerprint impression. Post this, your account instantly converts to a savings account. You need not submit any physical documents. Here’s where it wins out against Paytm as Paytm currently only has an invite-only option for a payment account. digibank not only offers the best interest rate on saving account as compared with other banks, but also has class apart features which differentiates it from any other bank account or payment bank account for that matter.

Let’s take a quick a look at how it fares against the competition:

| Feature | Digibank | Paytm | Airtel |

| Interest | 7% interest rate on amounts up to 1 lakh | 4% interest rate

|

7.25% interest but hidden charges involved |

| Debit card | Free Visa debit cards | Paytm offers a debit card for free only in the first year | Airtel Payments bank doesn’t even have the option |

| Maximum Limit | No maximum balance limit | Cap of 1 lakh

|

Cap of 1 lakh

|

| ATM Withdrawals | Unlimited ATM withdrawals

|

Three monthly free withdrawals | ATM Withdrawal charge of 0.65% |

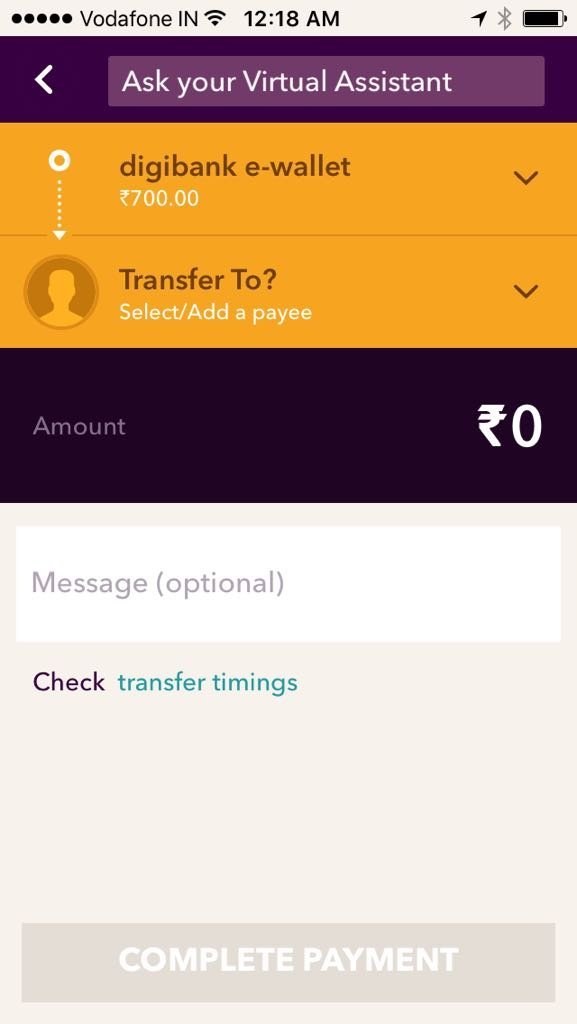

digibank also comes with a 24×7 virtual assistant that helps you get easy answers to your queries. It is now UPI enabled and it has the best UPI interface which is not at all complicated as other banks.

In a day and age where banking has become synonymous with long queues and endless paperwork, digibank is probably the easiest way to open a bank account that I’ve come across. Being India’s first mobile-only bank, digibank certainly has the potential to make banking simple and paperless. It’s still early days, but the whole concept has what it takes to banking to a whole new level.

Most importantly, its lets you open new savings account without many hassles. Just submit your Aadhar Card or PAN card, get your biometric authorization and you have a digital savings bank account.